Fluxus Trade Lab is where you fine tune your craft with professional-grade research and rigorously collected data.

Trade with Confidence

The 2% Better Approach

This approach is rooted in a community-driven ethos where collective learning and individual progress are paramount. By joining Fluxus Trade Lab, you'll be part of a supportive network that values rigorous analysis, strategic thinking, and collaborative learning. These all aim to refine your trading skills and achieve relentless consistency. We don't promise overnight riches, we promise a disciplined, systematic approach to trading. Our methods are tested and proven, focusing on long-term success, relentless consistency and 2% improvement every month (with compounding, 100% better in Year 3).

DATA, DISCIPLINE AND DECISION

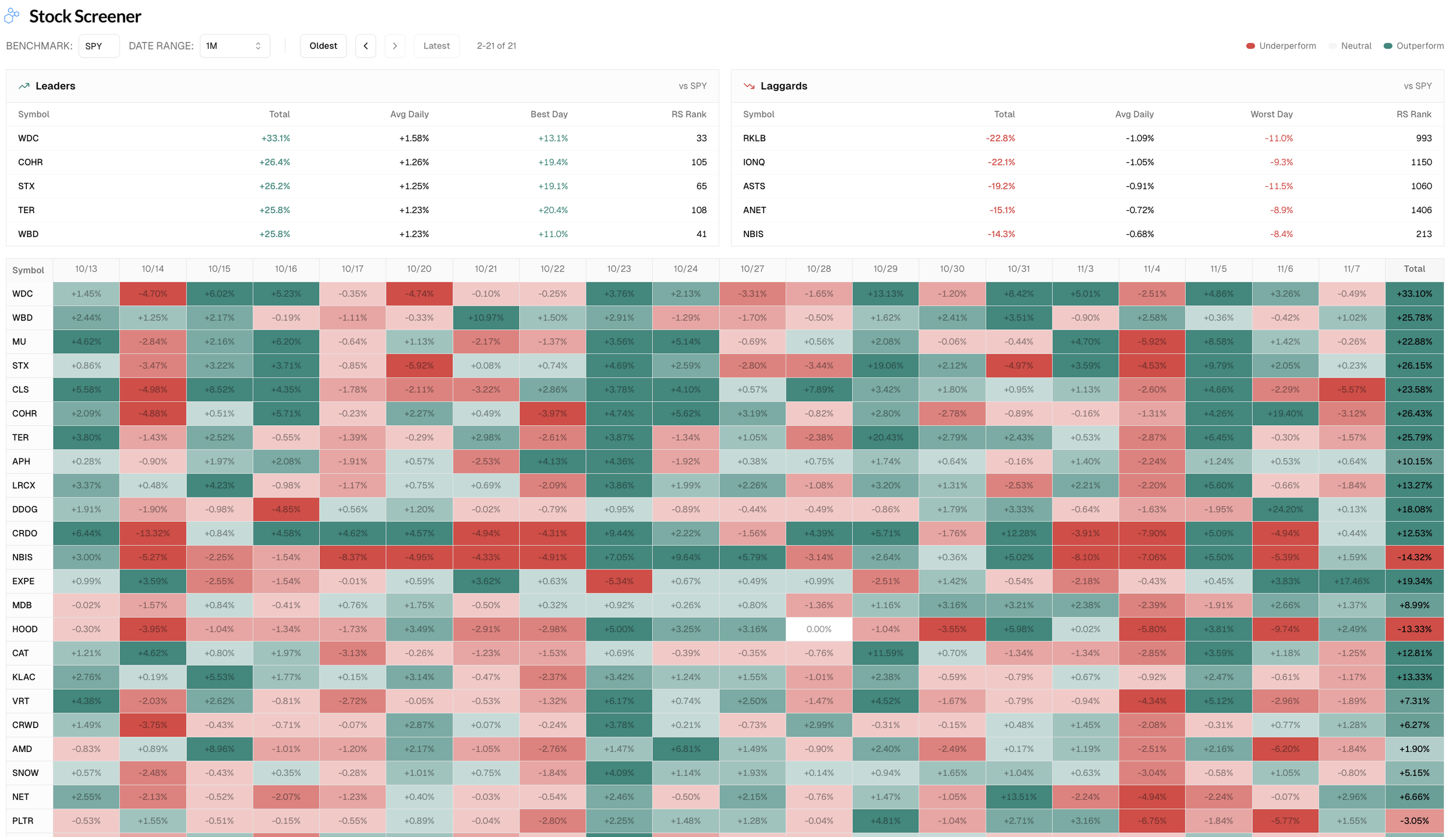

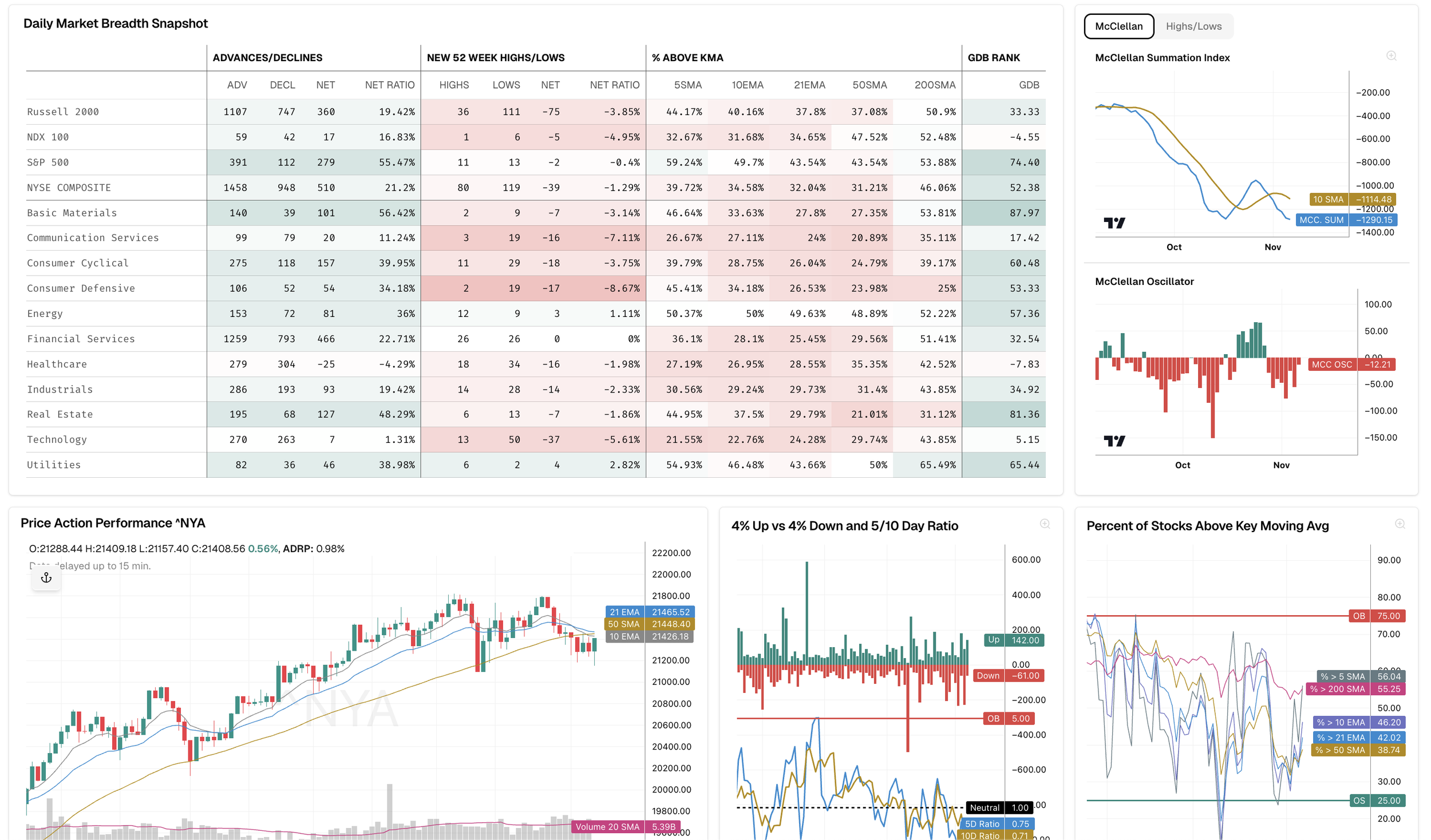

Fluxus Trade Lab follows the military OODA model where data guides insight, discipline shapes execution, and decision turns strategy into consistent performance. The emphasis is on cutting out noise to focus on the few personalized metrics that matter—think like a data scientist for your own trading.

TRANSPARENT, NO-NONSENSE TRADING

Fluxus Trade Lab is centered on honesty and transparency in both successes and setbacks. The community doesn't shy away from discussing losses, viewing them as essential learning opportunities. It underscores using a proven and adaptable trading system that evolves with market changes. This approach fosters trust and realism, setting realistic expectations for traders at all levels, and emphasizes the importance of strategy and adaptability in the dynamic trading world.

2024-2025 Trade Ideas

CLS + 830%

•

SMCI + 953%

•

PLTR + 78%

•

GGAL +41%

•

with a couple small losses in between too:)

•

ALAB short +34%

CSIQ + 69%

CLS + 830% • SMCI + 953% • PLTR + 78% • GGAL +41% • with a couple small losses in between too:) • ALAB short +34% CSIQ + 69%

Holiday Shopping or Re-invest into yourself?

This course offers a complete, data-driven approach to swing trading, guiding you through a proven process to identify market cycles, spot true leaders, and execute winning setups. Focused on building a strong trading mindset and leveraging data, you'll learn actionable strategies from expert insights—empowering you to make smarter, consistent trades. Unlock your potential and transform your trading journey today!

FAQs

-

In the first 4 days, sessions are divided into two with one 15min break in-between.

Session 1: 10AM — 12PM EST | Session 2: 12:15PM — 2:00PM EST

The recorded session will be replaying 6PM-10PM EST on the same day for those who cannot make it. Commentary is supported for the replay within 12 hours.

On the 5th day, live action day will start one hour before the market opens.

There will be two AMA(Ask Me Anything) live streaming sessions during the weekday. Time TBD.

-

Aspiring traders who wish to pursue a long-term career in trading

Performance oriented individuals with a growth mindset

Those wanting to learn systematically from successful futures traders

People wishing to develop a trading process and routine in developing an edge trading framework

Traders with at least 2 years of experience and basic understanding of technical knowledge such as moving averages and volume profile

-

We’re often asked why profitable traders would “waste their time” selling courses if they’re making more from trading. A large part of the screen recordings are our own internal records so that we can review and learn more about ourselves. Like sportsmen who review their performance, so are we very fortunate to have a strong, collaborative mentorship culture where we analyze each other’s best and worst performance practices for the benefit of communal growth.

If you are tired of messy free contents, we are here to teach a system and turn information into knowledge. This excites us and hope it excites you too!

-

As a student, you will develop a data-driven methodology with AI assisted daily routines that can speed up your process.

Graduate traders gain a solid development framework and professional approach to swing trading strategies from entries, position sizing, exits and risk management.

This is not just an education to learn knowledge, but a course to trade professionally with discipline.

-

After the training, to further consolidate your learning, we provide access to all the daily recorded sessions for a further 2 months. You are also given access to the Premium Discord Membership Service and will have access to bonus data to work through. Further mentorships can be consulted upon request.

BONUS: if you are able to show us 3 months’ consistency track record after course completion, we are happy to give you a certificate and refund you the course fee. Limited to only 10 people per year.

-

Yes, please visit our social media channels on X and Youtube for more content.

-

Fluxus speaks fluent Mandarin Chinese and English, so cuurently two versions of the same course will be available. Please refer to the course specifics or DM us for confirmation.

Service Launch 1/2026

Pledge your support now to secure early bird pricing below!

Tier 1

$39

Fluxus Futures Room

Discord access

Real Time Alerts

Daily and Weekly ES/NQ Plan

Educational Library

Popular

Tier 2

$99

Fluxus Swing Trading Room

Discord Access

Daily Live Morning Voice Prep & Focus List

Real Time Alerts

Breaking News & Live Squawk

Institutional Research & Data

Option Flow Database

Educational Library

Tier 3

$120

Fluxus Discord Full Access

Everything in Tier 1 and Tier 2

Monthly Mentorship Sessions

Testimonials

Who is Fluxus?

Fluxus is a seasoned trader — once a fierce day trader, now a sharp discretionary swing strategist. In the trading community, he hunts swing setups when momentum screams aggression, and trades ES/NQ futures intraday when volatility calls for patience. Trained under a hedge fund manager who navigated all major bear markets since 80s, Fluxus applies a set of charting techniques, Auction Market Theory and risk control at the core. He approaches the market as a game of numbers and probability —always an apprentice of mathematics and an ally of volatility.

The name “Fluxus” pays tribune to the 60s-70s international art movement —a radical attitude and desire for continuous change in art and society.

“Insanity is doing the same thing over and over gain and expecting different results.”